Francisco J Romano, Cecilia Giralt - The Journal of World Energy Law & Business

The Argentine strategy

On 12 September 2023, the Secretariat of Strategic Affairs (SAE) presented the National Strategy for the Development of the Hydrogen Economy (ENH).

The ENH seeks to promote the hydrogen value chain, decarbonizing the country’s energy and productive matrix, and bringing about an opportunity for reindustrialization so that Argentina can expand exports and create new economic activities associated with this energy vector, while generating new skilled jobs that will strengthen the industrial framework, regional development, and innovation.

If the ENH aspirations materialise, new industrial poles (hubs) are likely to emerge for the production of hydrogen and its derivatives, such as ammonia, methanol and other synthetic fuels, which can be applied in various products, including fertilizers, green fuels, and green steel.

This may give rise to new production and service sectors that will demand advice and equipment linked to value chains, such as hydrogen certification services, engineering, transportation and port logistics, electrolyser manufacturing, capital goods linked to renewable energy generation, carbon capture, use and storage, and water desalination, among others.

Therefore, the dynamics that will encompass this new hydrogen economy will not only be very powerful but will also be based on innovation as a driver for scale production and cost reduction. ENH aims to reach a production of 5 million metric tons per year by 2050, 20 per cent of which would be placed in the domestic market with the remaining 80 per cent destined for exports. This target will call for the installation of at least 30 GW of electrolysis capacity and 55 GW of new renewable energy generation , implying an 11-fold increase in current renewable generation and more than doubling the total national electricity generation capacity.

What are the hydrogen colours promoted by ENH and other countries in the region?

According to the ENH, Argentina presents competitive conditions for the production of low-emission hydrogen and, in this sense, the strategy promotes green hydrogen (based on electrolysis of water and biomass), blue hydrogen (based on gas with CO2 capture), and pink hydrogen (based on micro-nuclear power plants).

The strategy, projects the country as a potential producer of these three colours for both the domestic and international markets, considering the existing advantages of the existing industrial and scientific capacities, which generates synergies in this fledgling sector, enhancing opportunities. The reason why Argentina has chosen to develop these colours in its ENH is because of the energy resources and capacities in its energy matrix, with natural gas as a fundamental source for the energy transition and the potential development of small nuclear generation plants for pink hydrogen.

The Strategies or Roadmaps of the countries in the region have largely focused their efforts on the development of green hydrogen.

This has been determined by Chile in its national strategy launched in November 2020, focusing on the decarbonization of its local industry and the production of green hydrogen for export, based on the following stages.

Stage I: 2020–2025 (activate domestic industry and develop exports)

The deployment of green hydrogen will be carried out in six priority applications to build a local market: (i) Use in refineries; (ii) Domestic ammonia; (iii) Mining trucks for high tonnage extraction (CAEX); (iv) Heavy road trucks; (v) Long-range buses; (vi) Injection into gas networks (up to 20 per cent).

Stages II and III: 2025–2030 and 2030+ (Scale up to conquer global markets)

Stage II: Leverage local experience to enter strongly into international markets. The aim is to build a green ammonia production and export industry by attracting and promoting GW-scale consortiums. In addition, agreements will be established to accelerate the development of hydrogen exports.

Stage III: Exploit synergies and economies of scale to advance as a global clean energy supplier. As other countries strengthen their decarbonization initiatives and new technologies are developed, the export market will scale and diversify. New applications will include the use of green ammonia in shipping and synthetic fuels in aviation.

The strategy also has key pillars that underpin the action plan to take the strategy forward.

Uruguay published its Green Hydrogen Roadmap in June 2022, promoting in its Phase 1 (2022–2024) the development of the domestic market and laying the foundations for the first export projects, and in its Phase 2 (2025–2029), with the intention of scaling up the domestic market (demand and projects), to have the first projects in operation for export (such as e-methanol). Phase 3 (2030+) In this phase, the opportunities must be capitalized, given the existing national capacities and infrastructure, the momentum of growth of the export markets for H2 and its derivatives, thus consolidating the development of the domestic market.

Colombia published its Roadmap in October 2021, promoting two types of hydrogen: blue and green. The objective is that by 2030 green hydrogen can be produced in the northern Caribbean, where the best renewable resources are concentrated, at a value of US$1.7/kg, while blue hydrogen can be produced at a cost of US$2.4/kg. By 2050, it is expected that this value for a kilo of green and blue hydrogen will be around US$1.

The Roadmap calls for 1–3 GW of electrolysis capacity in the next 10 years, which implies a dedicated installed capacity of 1.5–4 GW. The country has also carried out a series of reforms in its laws to promote investments and the installation of pilot projects with different applications, in order to be scalable.

Paraguay, through the proposal ‘Towards the green hydrogen route in Paraguay,’ proposes green hydrogen as an energy vector that can contribute to the development of the country’s energy sector, mainly for transportation, highlighting the advantages of the energy use of green hydrogen by taking advantage of the large hydroelectricity surpluses.

In South America, Brazil leads the development of hydrogen in the different phases of the value chain. Although it does not have a national strategy, it has an R&D program on hydrogen energy use, and co-led the United Nations High-Level Energy Dialogue, presenting a hydrogen energy pact as a voluntary commitment aimed at accelerating the fulfilment of Sustainable Development Goal 7. The ‘hydrogen energy compact’ aims to promote the development of the hydrogen industry and market in the country. Thus, it has been proposed that the production of green hydrogen be destined both for the domestic market and for export.

Finally, although it does not have a Roadmap or National Strategy, Bolivia has established a Strategic Plan for the Generation of Green Hydrogen promoted by the Ministry of Hydrocarbons and Energy, focused on a gradual transition in different phases.

Apart from the aforementioned reasons, understanding the development of hydrogen in countries in the region, is essential to weigh the possibilities of scientific, technical, and commercial cooperation, as well as complementarity in infrastructure.

The technical knowledge available in those countries will also allow us to generate joint value proposals for the local manufacture of parts and components and/or assembly of equipment, the commercial exchange of equipment, products, and services and the exchange of experience in public transport without carbon footprint.

But let us talk about costs

The ENH assumes that the main challenge facing the global low-emission hydrogen economy lies in production costs and defines that the production cost of blue hydrogen would be between 1.1 and 2.1 US$/kg (natural gas), while green would be between 6.4 and 2.8 US$/kg considering the quality and availability of renewable resources in different locations, with the Patagonian region being the most competitive under current conditions. The cost projection for pink is not included.

The cost of green hydrogen production depends mainly on the primary energy, the infrastructure associated with the supply chain, and the volume of production.

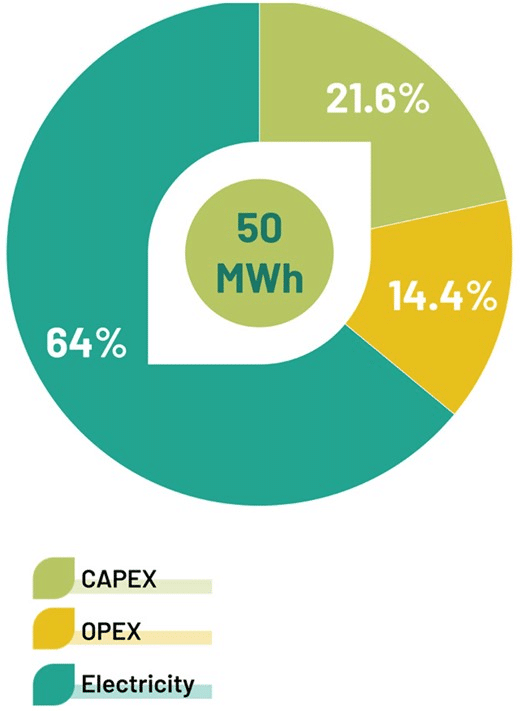

To calculate it on a homogenuous basis for all production routes we need to resort to the levelized cost of hydrogen (‘LCOH’), defined as the quotient between the present value of hydrogen production costs (CAPEX and OPEX) and the present value of the mass of hydrogen produced for the project evaluation period.

This cost is a variable that indicates how much it costs to produce 1 kg of green hydrogen, taking into account both the estimated costs of the investment required and the cost of operating the assets involved in its production.

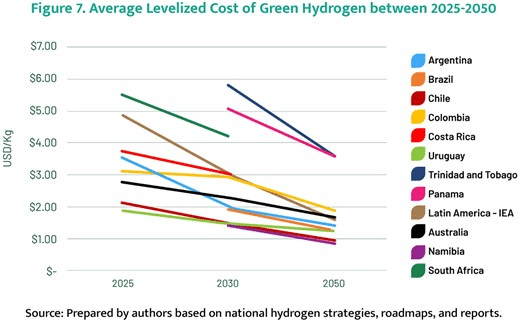

In its study, ‘Unlocking Green and Just Hydrogen in Latin America and the Caribbean’, the Inter-American Development Bank (IDB) analysed the impact of these variables on production costs in Latin America and the Caribbean.

In the image, we observe that the cost of electricity is the variable with the highest incidence. The report also shows the LCOH in different countries of the region and the most competitive countries in the world during the period from 2025 to 2050.

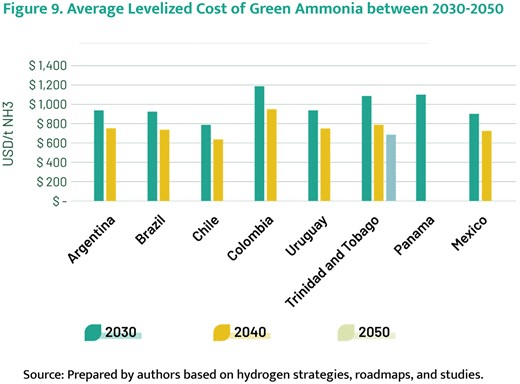

According to this analysis, we see that Argentina could be very attractive in terms of production costs of green hydrogen and its derivatives such as ammonia, reaching values that could compete with Brazil, Chile, and Uruguay, as long as it manages to improve the macroeconomic variables that characterize the so-called ‘Argentine cost’, starting with the high costs of financing and the tax burden.

This leads us to the conclusion that the region could become a net exporter, competing in origin with the production cost that can improve, and it is here where Argentina will have to generate the conditions so that the advantages it has to produce green or blue hydrogen at low cost are not discouraged by other situations that must be solved urgently. These issues to be resolved are: electricity, port and road infrastructure, lower logistics costs to export markets due to its geographical location, create the necessary macroeconomic conditions, particularly through the free flow of foreign exchange, ensure legal certainty and fiscal stability and articulate the necessary public policies to promote investment, make projects viable, and provide facilities for their location, among others.

In this sense, Chile, Uruguay, Brazil, and Colombia are far ahead of Argentina, currently emerging as important players in the international context, anchoring pilot projects in their territories that they intend to scale up for different applications and markets.

If we analyse Argentina’s domestic market, the country currently produces 0.4 Mt of grey hydrogen per year for consumption, which represents 9 per cent of the Latin American market (4.4 Mt) and approximately 0.4 per cent of global demand (94 Mt). However, the international trend is to decarbonize the industrial matrix, so grey hydrogen must be gradually replaced by low-emission hydrogen (green or blue), considering the costs associated with CO2 capture, a fundamental issue when making decisions in this regard.

According to the ENH, the domestic demand for low-emission hydrogen will show sustained growth from 2030 onwards, reaching 100,000 tons per year in 2035. By 2045, a demand of 500,000 tons per year is expected, reaching 1 million tons by 2050.

A central theme: certification

The great challenge that Argentina and the region will face in order to be able to export is the adoption of a certification system that harmonizes with the requirements of the destination countries.

Hydrogen certification is an important issue for the development of this incipient economy, the destination markets being the ones that will set the rules. In this sense, regional cooperation for the creation of a harmonized regulation is seen as a strategic opportunity to enhance the role that Southern Cone can play in the global context as a hydrogen supplier.

Given this, the ENH proposes to strengthen a set of actions for this cooperation such as: consolidating Argentina’s participation in international forums and other instances of cooperation related to hydrogen and/or energy transition; working jointly with MERCOSUR partners in the processes of technical definitions related to certifications and technical standards on hydrogen, its transportation and use; among others.

In terms of international and regional cooperation, it is expected that Latin America will be able to respond to more than 30 per cent of the demand from Europe and Asia.

Industrial and scientific capabilities and employment generation

The expansion of hydrogen production will require a set of capital goods and complementary technological services, such as electrolysers for hydrogen production, parks for renewable electricity generation, and knowledge-intensive services, such as engineering, among others.

In addition, there is a wide range of electromechanical components and equipment associated with this industry, which will be key for transportation and storage. This highlights a growing demand for capital goods worldwide and opens an opportunity for the establishment and development of specialized suppliers in Argentina.

The industrial, scientific and technological capabilities existing in the country may make it feasible for part of the supply of technology, electrolysers, and other capital goods and services to be generated locally.

The ENH defines that before 2030, Argentina has the objective of mastering the alkaline electrolysis technology, which will allow transferring to the industry the knowledge that will enable the serial production of these critical technological goods and supply the initial phases of large-scale production projects.

In terms of jobs, the expansion of domestic and international demand for this energy vector, along with other activities, will encourage a positive balance between the jobs that will be created and those that may be affected as a result of the transition to clean energy. This includes new jobs in the construction, operation and maintenance of infrastructure, not only for low-emission hydrogen production but also for transportation and refuelling. Part of this employment demand will be satisfied from the reconversion of occupations linked to the extraction and production chain of fossil fuels and renewable energies.

It is expected that more than 13,000 highly specialized jobs will be generated by 2030 and more than 82,000 by 2050.

In addition, the development of the hydrogen economy will require the deployment of new infrastructures and the adaptation of existing ones. The constitution of at least five productive poles or hubs is foreseen. If we consider the production of hydrogen from natural gas with carbon capture, utilization and storage technologies, infrastructure related to the transport of CO2 from capture sites to locations with potential for reuse and/or large-scale storage will be needed.

As for the capital required to carry out the expected production in ENH, it is estimated at around US$90 billion. In this sense, it is essential to have an active policy of investment search and promotion of the opportunities offered by the country, which will allow Argentina to establish itself in world markets as a safe and reliable supplier of hydrogen, ammonia and low-emission synthetic fuels. The ENH establishes actions for the promotion of these investments.

Final reflections—now the law… and everything else…

We highlight several positive aspects of the ENH, but above all, it considers the composition of the energy matrix in terms of primary energy for its use and it is based on the understanding that the country must position itself as a relevant global supplier within a joint regional agenda where complementarity reigns.

Now, a law is needed to strengthen, through a strategic vision, the competitive advantages of the country, fundamentally to lower the LCOH, reducing uncertainty and providing a framework of predictability in the rules of the game in the long term.

But the strategy and the law are not enough.

Regulations are also required that contemplate the fundamental aspects to promote the value chain, technical safety and environmental regulations, certification of origin, and subway storage of CO2, essential to generate blue hydrogen, among others.

For the export market, it is necessary to understand not only its rules, but also all the technical, quality, and safety requirements of potential buyers. In a world that is moving towards decarbonization and permanent innovation, colours have already been left aside to talk about low-emission hydrogen.

So, what are the requirements for certification of origin, traceability, and additionality (installation of new renewable generation facilities) that these markets will demand? Will there be market segmentation? And in this sense, can we think of selling blue hydrogen to Japan and green hydrogen to Germany?

All these questions will be answered as demand begins to be defined, and new ones will surely open up as the hydrogen economy begins to take shape.

But beyond these questions, the system must be based on a framework of legal certainty and macroeconomic conditions that generate the confidence necessary for contract compliance and fiscal stability.

Will Argentina be able to provide these guarantees and become a global player in the hydrogen economy?

Both authors have participated with Marina Paradela in the ‘Study of the Technical Regulations for Hydrogen Development in Argentina’ as awardees of the tender process conducted by the Argentine Government and financed by IDB.

© The Author(s) 2023. Published by Oxford University Press on behalf of the AIEN. All rights reserved.

Article published in: